Low prices spur sales at Riviera high-rise

Four years ago, the Marina Grande condominium in Riviera Beach was among the first Palm Beach County condos to experience the buyers’ remorse crowd. As the market for flipping real estate died during early 2007, dozens of investors at Marina Grande scrambled to try to undo their pre-construction contracts.

Four years ago, the Marina Grande condominium in Riviera Beach was among the first Palm Beach County condos to experience the buyers’ remorse crowd. As the market for flipping real estate died during early 2007, dozens of investors at Marina Grande scrambled to try to undo their pre-construction contracts.

Now Marina Grande is finding popularity with buyers who can’t resist snapping up the properties at discounted prices.

The sudden interest shows that people will buy condos – at the right price.

During the past three months, about 30 residences have been sold by the property’s owner, bringing the number of unsold units down from 349 when the property opened in early 2007 to only 56, said Rick Cortez, a Marina Grande sales agent.

Some units are selling in the $200,000 to $300,000 range, or around $140 to $170 per square foot. During the boom, some units sold for more than twice that amount.

Buyers can get units for even less money by scooping up short-sale properties. Kevin Dickenson, of Prudential Florida Realty in Palm Beach Gardens, said he has buyers who are picking up deals for $90 to $100 per square foot for units with ocean views. One investor owns five, “and has 11 more under contract,” Dickenson said.

Prices tell the story: One of the units originally sold for $674,500. Dickenson’s investor bought it for $215,000, or about $100 per square foot.

Once purchased, units are rented out immediately. Dickenson said one rents for a whopping $6,000 a month during the winter season. Marina Grande, located at the foot of the Blue Heron Bridge to Singer Island, was supposed to help revitalize Riviera Beach. But much like Boynton Beach to the south, the hoped-for neighborhood rebirth did not take place. Then the flippers market died, and the developer got squeezed.

Boca Developers, which built Marina Grande, handed the property to its lender. Word is bulksale offers of around $125 per square foot for unsold units have been rejected by the lender, especially now that the building is nearing sell-out.

Cortez said an aggressive marketing plan is luring buyers. Some are international, from Germany or Canada, while others are local or from the Northeast. The plan is to try to sell out the rest of the property this season.

Barbara Anne Fox, a real estate agent with One World Realty in Singer Island, was one of the first buyers at Marina Grande, paying $360,000 for her unit. Now she’s also selling units in the property for under $200,000. She’s even doing some short sales, even though the sales undercut the price she paid for her residence.

While Cortez acknowledged that short sales can turn a unit for less money, he noted that short sales are unpredictable. Buying from the lender means a buyer can close quickly, and with a warranty, he said.

Despite the lowered prices, Fox said Marina Grande is a well-run property, with a new board that has cut association fees and a property manager who lives on-site.

Fox said the property has received attention from buyers curious about nearby Singer Island now that it is home to the new Ritz-Carlton Residences.

Marina Grande isn’t The Ritz, but terrific water views help close the deal. “People stand on the balcony for five or 10 minutes. They can’t even move,” Cortez said.

Speaking of The Ritz

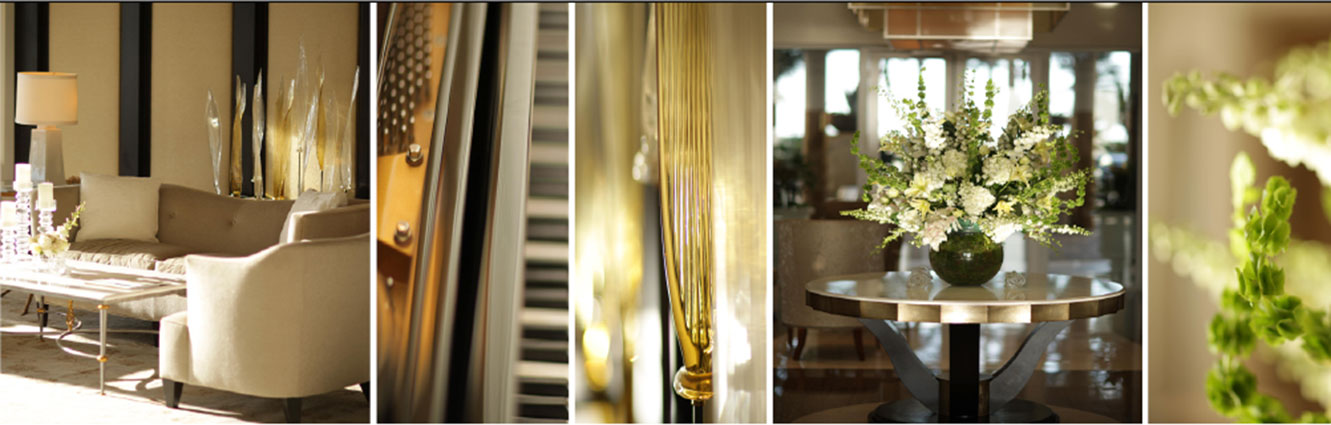

The Ritz-Carlton Residences Singer Island hosted its grand-opening party Friday night, as the celebrated luxury hotel brand formally launched the latest property in its residential collection.

The Ritz is the former 2700 N. Ocean condominium, which was built by Palm Beach Gardens’ Dan Catalfumo. Last year, Catalfumo sold the project’s unsold units to a partnership known as Lionheart Capital LLC, a joint venture between Miami and New York real estate entities.

Lionheart then teamed with Ritz to brand the luxury twin-tower condo a Ritz resort. Units began selling as Ritz residences in November. Despite the lack of fanfare, the Ritz name has netted $20 million in sales at the property during the past two months, according to a Lionheart spokeswoman. Prices range from $700,000 up to $10 million per unit.

Restaurateur Dave Manero is jumping on the burger bandwagon: He is launching a venture known as BurgerFi. The name is short for burgification, a made-up word meant to capture the retro trend toward Americans eating more hamburgers. But don’t think greasy burgers. BurgerFi plans to feature burgers made from Angus beef, raised without hormones or steroids. (Veggie burgers are available, too.) Hand-cut fries, frozen custard ice cream and shakes also are in the menu.

BurgerFi’s first store opens at Commercial Boulevard and North Ocean Drive in Lauderdale-bythe-Sea on Jan. 31, said Tom Prakas, a Boca Raton broker who handled the deal. More stores are planned for South Florida, and several are in the works for California. Franchises are available, too, for about $500,000 a pop.

Also in the works: Plans to take over numerous Johnny Rockets locations and transform them into BurgerFi, said Prakas, of the Prakas Group.

Manero said his plan for this new concept grew out of eating trends observed at The Office, his hip American gastropub in downtown Delray Beach. Manero said he couldn’t help but notice that burgers made up a lot of the orders.

He also saw his eateries, such as Vic & Angelo’s in Palm Beach Gardens and Delray Beach, were missing a big part of the dining public: People with families who are on the go but still want good-quality food at lower prices. Prices start at $2.87 for a small BurgerFi burger and $5.57 for a double burger.

“I see BurgerFi as the next Chipotle of hamburgers,” Manero said.